TCV Featured Crypto Asset: Equilibria(XEQ)

Very important disclaimer:

XEQ is a very small market cap crypto asset, and at times, it can be very illiquid, so please

exercise caution and don’t chase the price up hundreds of percent the first day. Many people

who have done this in the past for our previous crypto picks have regretted it later when the

price came back down.

If you are going to invest, make sure you only invest what you can afford to lose. We have

added XEQ to the TCV portfolio, but it is an extremely small cap coin, so it’s very likely that its

price movements will be extremely volatile. We have allocated XEQ at only 3% of the entire

crypto portfolio due to its very tiny market cap. As of October 11, 2021, the price was $0.50.

While we believe the upside/downside is skewed in favor of a long position, if XEQ rises

exponentially too quickly, it could easily drop back down just as quickly. However, we could

also potentially raise our target if the buying volume appears to remain strong and if there is

major fundamentally positive news to support that move. Please be mindful of risk

management, and keep in mind your investment time horizon, because if the price drops, it

could remain low for a long period of time before the next bull market. Please use caution!

Why is Equilibria (XEQ) important?

Monero(XMR) is to Bitcoin(BTC)

As

Dero(DERO) is to Ethereum(ETH)

As

Equilibria(XEQ) is to Chainlink(LINK)

Equilibria (XEQ) is a hybrid proof-of-work (PoW) / proof-of-stake (PoS) crypto asset which

promises to solve the problem of leaked and otherwise compromised information from public

oracle requests currently used by smart contract platforms. We see the potential for it to

capture a significant portion of Chainlink (LINK)’s market share, as well as cement itself as the

go-to oracle for private smart contract networks.

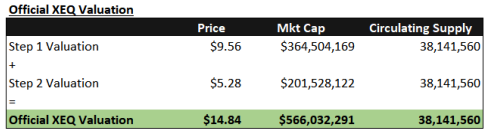

Based on what we feel are conservative assumptions, we arrive at our official valuation of

approximately $15 per XEQ, representing a 30x return based on current prices. However, as

we believe the market’s valuation of oracles as a whole will rise, we apply an additional

multiplier to the part of our analysis referencing LINK. In consideration of the complexity

associated with this estimation method, we refer to the resultant $24 estimate for XEQ as our

unofficial target – which represents an approximate 48x return based on current prices.

Despite being ‘unofficial’, we believe this estimate to be conservatively derived and think it

possible for actual sector multipliers to be materially higher.

Please note that we are adding XEQ to our TCV Portfolio with an initial 3% allocation. To make

room for it, we are eliminating Chainlink (LINK) and Ethereum Classic (ETC) (which until now

contributed 2% and 0.5% respectively). The remaining 0.5% comes to XEQ by reducing our

Ethereum (ETH) allocation from 2.5% to 2.0%.

Where do I buy it?

Before buying, we highly recommend reading this text on coin control to do it in the best (safest) way possible.

We only trust TradeOgre for trading Equilibria right now. This exchange has no KYC required

and no withdrawal limits, and it currently has the most liquidity/volume:

https://tradeogre.com/exchange/BTC-XEQ

How do I store it?

The official Equilibria wallet is a well-designed and simple to use GUI interface. It is very easy

to store and stake XEQ with it.

If you already have an official Monero wallet (GUI or CLI) on your computer, DO NOT

INSTALL the Equilibria wallet until AFTER you have read the complete TCV set-up

instructions for the Equilibria wallet at the end of this report.

Graphical User Interface (GUI) Wallet:

https://www.equilibria.network/

Rounding Out the Privacy Eco system

As most of our subscribers are already aware, here at TCV we are proponents of crypto assets that

offer true privacy, and enable the resilience of the private economy. We see privacy coins supporting

fundamental moral values, and view being tracked and spied upon as inherently unethical and wrong

for humanity. We therefore see that in addition to the three traditional qualifications for ‘sound money’

(store of value, medium of exchange, and unit of account), fungibility stands as just as necessary.

But we’re also investors. Supporting a moral ideal is well and good, but we always ask whether or not

there is merit to an idea as an investment.

One of the most exciting things about the privacy coin market today is that in addition to the philosophy

behind it, it’s an exceedingly attractive investment. Even using what we believe are conservative

assumptions about relevant market forces, estimated forecast returns are significant. For our most

recent valuations of Monero (XMR), Pirate Chain (ARRR) and Wownero (WOW) – the Privacy Trinity –

see Mr. Z’s articles in the TCV August 2021 Issue and TCV September 2021 Issue.

In our TCV Featured Crypto Asset Dero (DERO) – June 21st, 2021 release, we showed how Dero is

expanding the private and fungible money economy by introducing smart contracts that are also

private. We followed up on this with a Dero valuation update in our TCV Featured Crypto Asset: Dero

(DERO) – Valuation Update – September 11th, 2021 release.

However, for Dero to be able to offer a truly private smart-contract ecosystem on par with

Ethereum-based platforms, it actually needs one more thing – a private oracle.

It is therefore only natural that our current TCV Featured Crypto Asset Report is focused on Equilibria

(XEQ), a private oracle.

A Brief Smart Contract Refresher

As we discussed in our Dero report, a smart contract is essentially a computer program which lives on

a blockchain, and through which all sorts of transactions can be made. The most popular types today

relate to decentralized finance, or DeFi. These range from lending/borrowing digital assets, to creating

algorithmic stablecoins, to trading services that don’t require a middleman custodian.

The value created by these types of applications has been enormous. Without going into too much

detail, we’ll simply point to the fact that the combined market cap of DeFi protocols currently stands in

excess of $130 billion – and that’s in addition to the market cap of the top smart contract networks

(Ethereum, Cardano, etc.) which exceeds $600 billion.

But there is one glaring issue with the vast majority of these smart contract ecosystems: they aren’t

private at all.

Our Dero investment case is based on the understanding that a significant portion of the population will

prefer to engage with smart contracts fully privately. However, to maintain optimal privacy in the Dero

ecosystem, we need to ensure that all connections to and from it are also private. This brings us to the

one major type of ‘connection’ that Dero needs to work with – oracles.

What Is An Oracle?

In ancient times, an oracle was a type of spiritual intermediary – a person

who could speak on behalf of the gods, and so dispense truth. The most

famous in recorded history is undoubtedly the Oracle of Delphi which

spoke on behalf of the Greek god Apollo.

In modern parlance, and in particular when it comes to blockchains, an

oracle is something that’s used as a source of truth – something that is

needed to conduct most smart-contract transactions (especially in the

DeFi world).

The problem with smart contract blockchains is that they are

technologically closed systems. There is no native way for them to

communicate with the outside world to get information about what is

happening in the outside world – and many, if not most, smart contracts

need some information from the outside world to transact. It could be

crypto or stock prices, sports scores or the weather. Any relevant data that

can be provided by some outside ‘feed’ is fair game.

For instance, suppose you put a conditional buy order for Cardano into a smart contract on the

Ethereum network. The order might effectively say something like this:

If the price of Bitcoin is below $50,000, I want to buy 1,000 Cardano (ADA) tokens at the current price.

This seems easy to manage, but in order for the contract to work, it needs to know if and when Bitcoin

actually trades below that price. Because the price of Bitcoin doesn’t organically live anywhere on the

network, the smart contract needs access to a technical intermediary. This intermediary, the oracle,

delivers and translates the requested information from an outside world source.

In its simplest form, an oracle is a “gofer” for transactions on smart contract networks.

The contract needs some bit of info, so it rings up the oracle and says “go fer” this, or “go fer” that bit of

information. The oracle gets the information, and submits it back to the blockchain to be used in the

smart contract. It gets paid for this service in the native token of that oracle ecosystem.

We NeedToTalkaboutChainlink

There has really only been one oracle of any note in the market – Chainlink. But who or what is

Chainlink?

Chainlink is a for-profit company, established through an ICO in 2017. This company provides oracle

services to smart contract networks, and only accepts payment for its services in the form of LINK

tokens – something that they created, and of which they own the majority.

There is a maximum supply of 1 billion LINK tokens, and only about 45% of them are in circulation in

the trading float. It is therefore a privately owned business, in which the majority of holdings are held

privately by those who determine any protocol changes.

It has nothing to do with any sort of egalitarian user or developer community. It’s a business that

develops and markets its own product.

There’s nothing wrong with any of this per se, but it’s

important that it be demystified.

With this perspective, let’s discuss some of its issues.

1) Chainlink, the company, keeps questionable

company.

Chainlink openly associates and works with some

well-known, and in our opinion, highly disreputable

globalist organisations, such as the World Economic

Forum.

For those not familiar with the WEF, it is a private organization of un-elected “elites” pushing the ‘Great

Reset’ agenda. We won’t go into further detail here as to why we think their plans are totalitarian and

atrocious, but we recommend that if this is new to you, you familiarize yourself with their activities.

When it comes to oracles – entities that are relied upon to be arbiters of truth – to be connected with

organisations that cannot be trusted will be a non-starter for many. It doesn’t take much imagination to

picture a scenario where this type of system can spectacularly work against free society.

To give an example, consider the following story shared with us, illustrating the power wielded by those

who control the ‘source of truth’.

Some years ago, construction workers in a particularly despotic middle eastern country were

complaining that they were being forced to work in hazardous conditions with no extra

accommodation. While the average temperature in which they were required to work was

around 40 degrees celsius (104 fahrenheit), there were many days where the temperature well

exceeded 50C (or 120F). The workers threatened to go on strike unless they were awarded

hazard pay for those days.

Management quickly struck a deal with the workers. On any day where the local news station

reported that temperatures exceeded 50C, the workers would be paid a 50% hazard premium.

The workers were happy with this offer and accepted.

Incredibly to some, and unsurprisingly to others, from that day on, the local news never reported

temperatures exceeding 49C. Despite workers ‘swearing’ that it was well in excess of 50C, this

was never reported, and the workers never saw a dime of that hazard pay.

Whom you trust to be the ‘arbiter of truth’ matters enormously when it comes to being treated fairly in

any contracted agreement. While there may not be an apparent immediate threat that the Chainlink

oracle system is acting improperly, having this level of power and authority so closely connected to

organizations of dubious trustworthiness is a huge red flag. And red flags such as these, from a market

perspective, mean that a competitor has an opening to differentiate themselves.

2) Chainlink is not private.

This is an even bigger issue.

In the same way that Ethereum’s lack of privacy enables Dero to differentiate itself in a meaningful way,

Chainlink’s lack of privacy paves the way for another private oracle to take market share.

Chainlink is actually refreshingly honest and straightforward when they talk about the lack of privacy on

their network.

Just kidding. They try to gloss over it and cover it up.

They are a business, after all, and we suppose you can’t blame them for trying to sugarcoat a serious

limitation of their service.

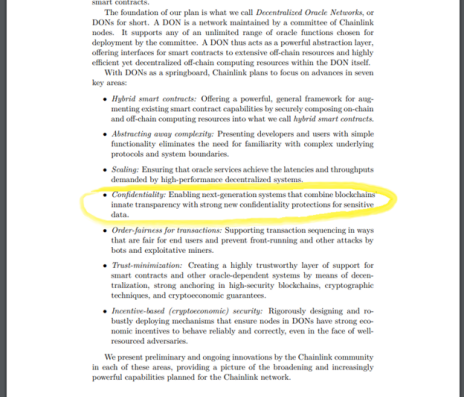

Below is a snapshot of their current whitepaper. See the part about privacy? Nope. Neither did we.

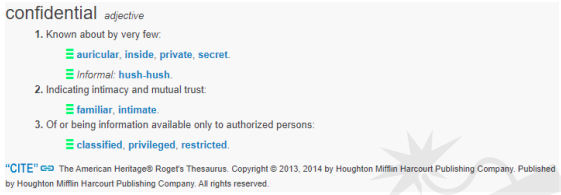

We do however see a part about confidentiality, and that’s what we’ve circled. They don’t offer privacy,

they offer confidentiality protections

Let’s assume for the moment that they actually can offer confidentiality in a public and transparent

surveillance network. What does confidential actually mean?

Confidential means others know about it, but like, promise to, like, totally keep the secret.

Unfortunately, in a world where any number of ‘official’ agencies can forcibly require confidential

information to be released to them, promises like these are not enough. To be truly private, the data

itself must not be in anyone’s possession, except for those performing the transactions themselves.

No, Chainlink is not private, and as a consequence, a central element of smart contract transaction

information is not private.

On this basis alone, we believe a large portion of the populace would opt to work with a private oracle

over a public one. As a consequence, this has remarkable implications for XEQ.

Equilibria(XEQ) -What Is It?

Equilibria is the base crypto asset for a private oracle that supports smart contracts.

If you like, you can think of it like this: Equilibria is to Chainlink what Monero is to Bitcoin, and what

Dero is to Ethereum.

TheXEQ Token & SmartContracts

Equilibria is a rebrand of Triton (XTRI), a proof of work coin launched in 2018.

Equilibria is a Monero fork. Transactions are private and untraceable. Just as anyone can mine

Equilibria as a Proof of Work coin, anyone can run their own Oracle Node and earn mining rewards

from its Proof of Stake component. Every Oracle Node is responsible for managing and making

decisions for the tasks required of each Oracle Service. It is vital that anyone can start an Oracle Node

to ensure no central entity is controlling the network or the blockchains utilizing the Oracle Node

Service called Equilibria Oracle Network, or EON (EON had previously been called Pythia – another

name for the ancient Oracle of Delphi mentioned above).

EON keeps Equilibria’s supply stable while maintaining a high incentive for further decentralization.

There is a small fee attached to each EON transaction split 40/40/20. Oracle Nodes will receive that

first 40% of the fees paid from EON. As the usage of EON increases, the ROI of running an Oracle

Node will also increase. With a higher ROI comes a larger incentive to run an Oracle Node resulting in

a more secure network. The next 40% of the fee is burnt to help stabilize the supply by offsetting the

emission rate. The remaining 20% of the fee goes to the team to fund the project over the long-term.

Equilibria’s oracle, EON, is capable of providing a solution to nearly any blockchain problem. Bringing

data to the blockchain is difficult, but helping other blockchains decentralize their network protocols is

even harder. EON became compatible with ETH via wXEQ in 2021, with other chains like DOT and

SUSHI on the roadmap ahead.

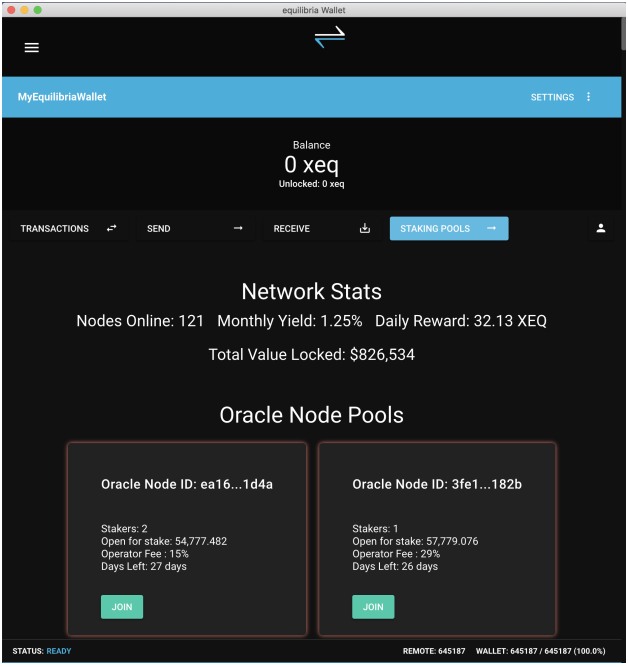

Staking is pretty straightforward and can be done directly from the GUI wallet. TCV performed a test

with a 1000 XEQ stake ($150 USD during the test) on a 9% fee Oracle Node Pool and we received

0.059 XEQ every 4 hours for 30 days while funds were locked up in the stake. This translated to 10.62

XEQ / month.

Oracle Node Pools can be set up by any XEQ participant. But are there any risks with staking? Staked

funds can never be lost as they are unlocked back to your wallet after 30 days. However, if the Oracle

Staking Pool you selected goes offline, staking rewards would stop while the pool is offline. Pool users

would miss out on the staking rewards during that downtime.

Staking larger amounts will obviously bring greater profits in both dollar and XEQ terms, but the ability

to easily earn XEQ staking rewards right from the wallet during a long-term hold can significantly

increase the profits earned at the end of the investment period.

Smart Contract Eco systems

It is a well known fact that ETH is not a private smart contract platform. Smart contracts have many

moving parts starting from the money that enters them, all the way through to how they validate

information to execute the functions built inside them.

A typical public contract ecosystem is publicly visible starting with the funds that enter it via Bitcoin or

other altcoin. All tokens acquired with these funds are also public. What happens with the tokens and

smart contracts is public. All requests smart contracts make to their oracles are public. The flow of

funds between them is public. And this brings us to the layer in which we are focusing in this report.

The image below shows the public smart contract ecosystem on the left side. The communication

between elements of the ecosystem and flow of funds are labeled as red lines. Those red lines are

publicly visible interactions and they also happen to be points where the new infrastructure bill in the

U.S. Congress may require both developers and participants to report all activity and work as actors in

a surveillance network.

The right side shows a private ecosystem where the same interactions and flow of funds are labeled as

green lines not visible to the outside world. This alone removes the reporting burdens created by the

infrastructure bill. Dero (DERO) is our private smart contract platform, but it too needs an oracle to

function properly. If Dero uses Chainlink, the information request will leak some level of information as

seen by the red X.

But, you might wonder, if Dero is private, then linking to data through Chainlink is not that bad of a thing

right? Consider this example. A Dero contract is making oracle calls. This contract is requesting

values for, let’s say, sporting events at regular intervals, making it pretty obvious it’s a sports gambling

contract. Some jurisdictions do not allow sports gambling so this small data leak puts that specific

contract (which is still a private black box) on their radar. This is now a black box to which they will pay

special attention. They’ll put surveillance on it, and anyone who gets caught interacting with this black

box could suffer the consequences.

This simple example shows the fundamental importance of a private oracle within a privacy ecosystem.

And this is why Equilibria (XEQ) is an integral part of it.

As the chart above shows, by preventing smart contract oracle calls to Chainlink we keep our

ecosystem as close to 100% private as possible. Equilibria is the perfect oracle for our private

ecosystem, making it nobody’s business what happens inside of it, except for the participants

themselves.

So we bring it all together now and imagine this entire privacy based ecosystem. If you are a developer

and you get to choose between the public or private versions, which would you pick?

The public version will expose the developer’s identity and require quite a lot more lines of code to

extract the required information in order to meet surveillance reporting requirements every step of the

way. The private version will not expose the developer’s identity, requires less lines of code and has no

reporting headaches.

We believe many developers will choose to do less work, in addition to not exposing themselves to

becoming actors in a surveillance network. And finally, users will always appreciate the privacy and

simplicity brought about by the entire ecosystem.

Valuation

The fact that Equilibria is directly comparable to Chainlink sets the stage for our XEQ valuation

exercise. In short, and with the notable exception of a Dero-specific component we’ll address shortly,

we value Equilibria on a relative basis to Chainlink.

We can value XEQ as an answer to the question: How much of LINK’s current market share might XEQ

take? When we arrive at that answer, we arrive at a preliminary valuation for XEQ.

Our approach examines the areas where XEQ offers a competitive advantage to LINK – namely, being

a more palatable (and less globalist friendly) alternative to LINK as well as being a solution which offers

privacy. As a consequence, we effectively need to ask (and answer) two slightly more refined

questions.

1) “What percentage of the big smart contract (ETH, ADA) developers and users might actively

select an alternative oracle to LINK, based upon Chainlink’s questionable reputation, and the

privacy features we’ve discussed?”

As already discussed, even away from Chainlink’s globalist associations, it makes much more sense for

developers to opt to use a simpler, and more private XEQ oracle. Add onto that the desire of

developers and users to choose an option not associated with a totalitarian globalist agenda, and we

feel estimates of 3-5% are very reasonable starting points. In the interests of conservatism and

considering we are just at the earliest stages of awareness in XEQ, we will use the lower bound of 3%.

With this, we arrive at a value of XEQ of nearly $10 a token.

However, this isn’t the whole story, and so we continue to the second question.

2) “What percentage of private smart contract networks (like Dero) would opt to use Equilibria, a

private oracle, over Chainlink?”

Almost by definition, the answer should be 100%. Not even considering the association and trust

issues of Chainlink, there’s no real reason to use anything other than a private oracle if you’re operating

on a private smart contract network. To do so would defeat the whole purpose of using Dero to keep

the whole transaction private.

Valuing this second component requires us to perform a couple of different steps. We must first identify

how the market values oracles as a percentage of the relevant smart contract platforms themselves,

and then apply this relationship to Dero’s forecasted market capitalization (here we use our revised

Dero valuation of approximately $750 per DERO

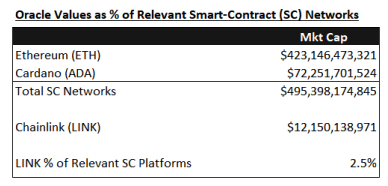

As illustrated in the table below, Chainlink’s market capitalization is approximately 2.5% of the

combined market capitalizations of both Ethereum and Cardano combined.

Note: While LINK’s percentage of the smart contract networks of 2.5% might appear small, it’s

worth remembering that while critical, an oracle’s place in the ecosystem is effectively that of a

small direct cost. From a value-add perspective, it offers limited additional benefit once a

suitability and reliability threshold is met.

When we combine this 2.5% parameter with our revised Dero valuation, we arrive at our Step 2

valuation for XEQ, and discover incremental value per XEQ of over $5.

To bring it all together, we add the values from each of our steps to arrive at our current valuation of

approximately $15 per XEQ.

While we call the above our official valuation, there is still one more component to take into

consideration, and it has to do with LINK and the value of oracles in general.

Because our ‘Step 1’ uses a percentage of LINK’s market cap as an approach, a reasonable question

to ask is, “At what price do we think LINK is fairly valued?” If LINK were to be worth, say, 5x current

levels, then that Step 1 value of $9.56 would ostensibly be worth 5x that estimate, or nearly $50. Add

this to our Step 2 valuation piece and we’d value XEQ at over $55 (never mind that we think the value

of Dero, and so the Step 2 piece, could ultimately be much higher).

So – what is a reasonable estimate of LINK’s future value?

At the TCV 2021 Virtual Summit Mr. Z discussed valuing cryptocurrency projects, and used Chainlink

as an example. While he caveated his exercise noting several significant inherent uncertainties, he

mapped out a framework using metrics around assumed network activity, fees paid, and the impact of

such fees on a static token pool. In his exercise, he arrived at a potential value for LINK of

approximately 9x its current value. If this were to hold, and be applied to our XEQ valuation above, it

would translate into a ‘Step 1’ valuation of XEQ of 9x $9.56 = ~$86. When complemented by the ‘Step

2’ value, this would bring our XEQ valuation to over $90 per XEQ.

Due to the relatively high level nature of that analysis and variability of its parameter inputs, we are not

currently endorsing his illustrative 9x valuation of LINK (though, as he did, we encourage those so

inclined to consider using his framework, along with your own parameter estimates). Nevertheless, we

believe the prospect of oracles being valued by the market at levels much higher than today’s is a very

real consideration. Consequently, we feel it reasonable to present our ‘unofficial’ valuation target for

XEQ, reflecting what we think is a conservative LINK valuation multiplier of 2x, or an XEQ price of

$24.40.

A Note on Price vs. Market Capitalization

From a fundamental basis, the price of a particular token is of no consequence – what matters is the

total market capitalization (the same thing holds for stocks by the way).

All else being equal, one should be indifferent between holding a $1,000 token with a circulating supply

of 1,000 tokens (and therefore a $1 million market cap) and a $1 token with a circulating supply of

1,000,000 tokens (still with a $1 million market cap).

In practice though, this is often not the case.

Many investors and speculators consistently prefer to put their money in lower priced tokens – and as

with other things in markets, if enough people believe something matters, then it does matter.

In the case of the XEQ token, this preference offers an additional tailwind in its pricing. Its current price of around $0.50 gives it significant room to rally while still being perceived as a relatively ‘cheap token’

by many who only look to its low nominal price.

This feature is enhanced by what is also an exceedingly low market cap. At $0.50 per XEQ, it’s total

market cap is under $30 million – significantly lower than the typical ‘low end’ attributed to early stage

coins with a viable product and significant upside potential (we often see these closer to $100 million).

As such, while we ascribe far more upside with respect to our valuation, the ‘low hanging fruit’ in terms

of price action may turn out to be a market capitalization of $75-100 million, which would translate into a

per XEQ price in the $1.50-1.75 range.

Time will tell how XEQ’s price will move in the coming weeks and months, but it’s worth noting that once

crypto assets demonstrate some stability in maintaining market caps of $100 million, the growth in

trading depth and breadth allows larger investors to begin to make more meaningful allocations,

creating something of a virtuous cycle. Of course, this should only hold true for projects that have a

solid fundamental basis and for which their valuation is ultimately much higher – but these are things we

see as present and relevant for XEQ.

Risks and Limitations

Equilibria is still in a very early stage of its development.

Awareness of its product and value proposition has only just begun, not just in the crypto investing

market, but in the developer community. That said, it’s because it is at an early stage that we think the

opportunity to buy into it at such an attractive level exists – especially considering that from a technical

perspective, its ability to scale into the oracle market appears so achievable. The fact that they’ve

already developed Ethereum interactivity and are targeting other smart contract networks demonstrates

just how real the technology is, and makes us feel that it’s only a matter of time before the market

wakes up to it.

Other competitors may spring up.

As far as we are aware, XEQ is the only significant private oracle of its kind. While copycat clones

could spring up, what we have witnessed in the crypto markets is that first-mover advantage (and

network effects) carry a lot of weight, unless a new competing product also offers some significant

advantage in terms of features and usability. Due to the relatively straightforward nature of the product

offering (giving smart contracts reliable, private connectivity to data feeds), we think it will be

challenging for any new entrant to offer a materially superior product that would offset XEQ’s first mover

advantage. Plus, it’s unlikely a competitor would materially enter the market before XEQ demonstrates

its value proposition by reaching much higher prices and market capitalization levels.

Our fundamental analysis derives a portion of its value based upon growth and usage in Dero, a private

smart contract network.

While we feel even stronger conviction in Dero’s outlook (as reflected in our revised valuation), and

believe that our forecast remains extremely conservative (at 1.5% of ETH market cap), it’s possible that

our expectations are too optimistic. However, even if we completely ignored the ‘Step 2’ element of our

valuation, we would still arrive at a value per XEQ of nearly $10 – and applying our ‘unofficial’ 2x

multiplier for broad oracle adoption (as reflected in LINK’s price), would get us to a nearly $20 valuation.

The developers take a cut of fees, and this may rub some people the wrong way.

We actually view this as a non-issue. Premines and developer cuts principally concern us when they

relate to non-egalitarian distributions of coins used as money, or introduce ethical governance conflicts.

But XEQ is not trying to be money, and so long as the protocol does the one thing it aims to do,

governance issues should remain a non-issue.

We have no problem with other people making money – especially if they do so by continuing to deliver

a vital service that supports the privacy economy. The fact that the price is currently so low (relative to

our valuation) means that investors today can get in and go along for the ride.

Equilibria (XEQ) Exchange

If you are interested in trading XEQ, we recommend using TradeOgre since it appears to be the most

liquid, trusted, secure, and stable exchange for this coin at this time.

https://tradeogre.com/exchange/BTC-XEQ

Equilibria Wallet Software and Additional Resources

The official Equilibria project website can be found at https://equilibria.network.

There you can find a plethora of information around and supporting the project.

For the Equilibria wallet, we only recommend using the official software for any significant amounts at

this point in time, since it is so early in development.

Equilibria (XEQ) Wallet Overview

We have overall been very pleased in our testing of the Equilibria wallet, both for its use to store and

send coins, as well as the ease with which staking pools can be entered. That said, we discovered a

few very important things to keep in mind when setting up and using the wallet

WARNING: PLEASE FOLLOW THESE STEPS VERY CAREFULLY BEFORE DOING ANYTHING.

1. Monero users who are already running a Monero CLI or GUI wallet on their computer should QUIT

the Monero wallet application BEFORE the installation and launch of the new Equilibria wallet. Make

sure you have backed up your Monero seed phrase before moving on.

2. The Monero wallet can never be run AT THE SAME TIME as the Equilibria wallet due to network

port conflicts between the two wallets. Always quit one wallet before launching the other.

3. During set up, you will be asked to name your new Equilibria wallet. The default Monero wallet name

is “MyWallet”. DO NOT USE the Monero default name or you could OVERWRITE your Monero

wallet file. Name your new wallet “MyEquilibriaWallet” or something different from Monero’s default

“MyWallet”.

Installing and Setting up Equilibria Wallet (macOS)

We tested the macOS wallet when creating these instructions.

Please note that we cannot provide support for this wallet – this is simply documentation of our

own experience when testing this wallet at the time of publication, for informational purposes

only.

The Windows wallet set up process is similar and simpler than macOS.

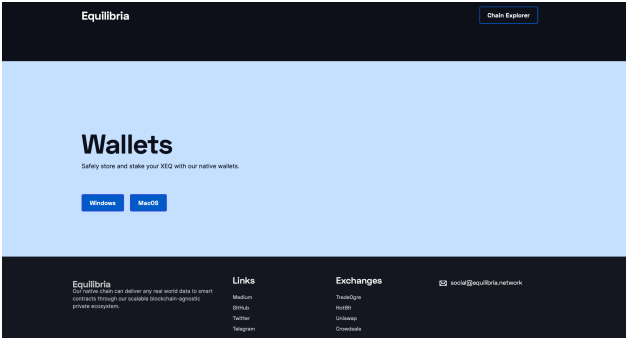

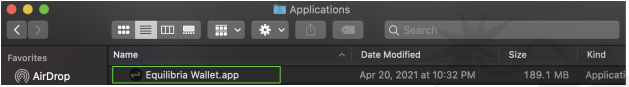

Step 1

Go to http://equilibria.network and select Windows or macOS wallet download.

In our example, we downloaded macOS.

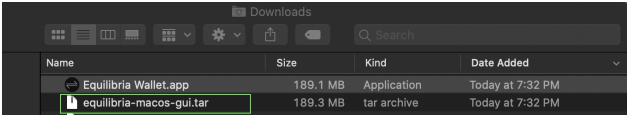

Step 2

Unpack the downloaded file by clicking on the .tar archive.

You will see an Equilibria Wallet.app file once it finishes unpacking.

Step 3

Move Equilibria Wallet.app to the Applications folder.

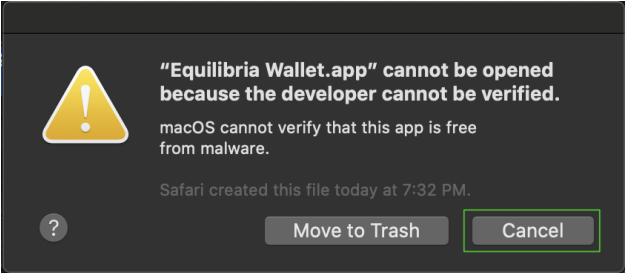

Step 4

Double-click to launch Equilibria Wallet.app and you will see the error message. Click Cancel.

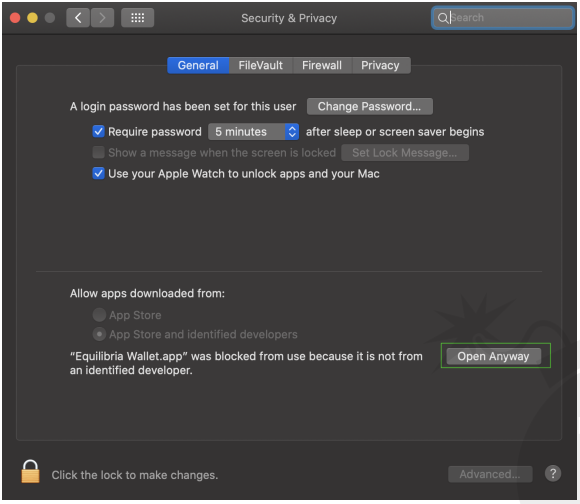

Step 5

Go to macOS System Preferences, Security & Privacy, and select the General tab

Click on Open Anyway.

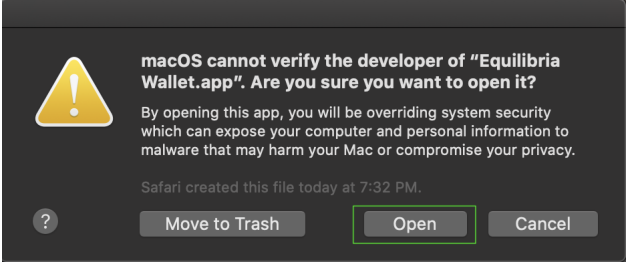

Step 6

The following warning message will appear. Click Open

Step 7

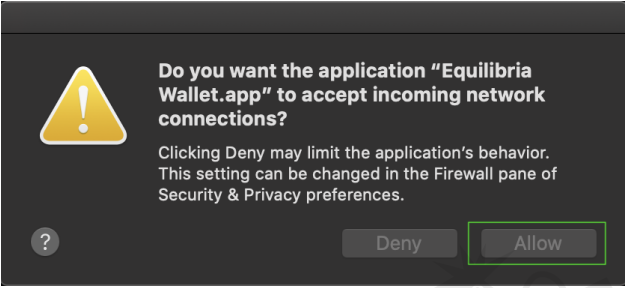

A second warning message will appear. Select Allow.

Step 8

The main wallet window will open. Select English.

Step 9

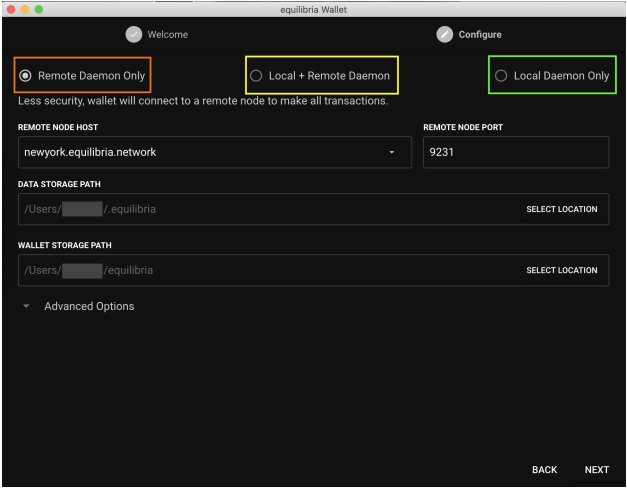

You have 3 options:

1. Remote Daemon Only. Least secure, fastest and depends on trusting remote nodes. It saves

disk space because it does not store the blockchain locally. You can start using the wallet

immediately.

2. Local + Remote Daemon. More secure, as it uses a local daemon when possible but will

connect to remote daemon if needed. This will use much more disk space to store the

blockchain. It will take a long time to sync but you can use the wallet immediately.

3. Local Daemon Only. Most secure, only uses the local daemon and will use the most disk space

at all times and not permit wallet connections to remote nodes. This will take a long time to sync

and you cannot use the wallet until sync is complete.

Leave all other settings unchanged. Click NEXT

Step 10

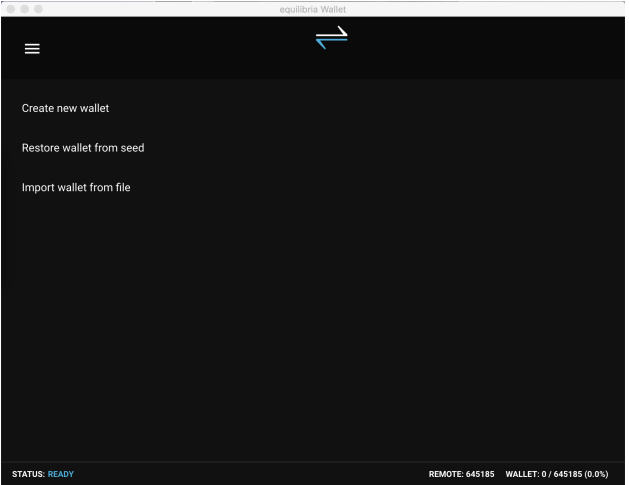

Select Create new wallet

Step 11

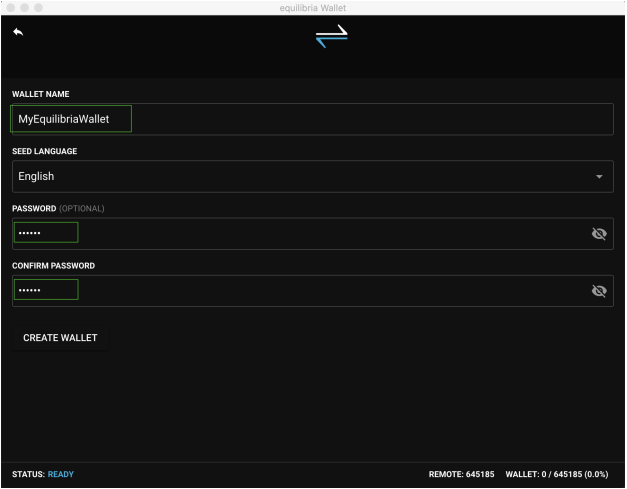

Enter wallet name. Use “MyEquilibriaWallet”.

DO NOT USE “MyWallet” or you could overwrite your Monero default wallet.

Enter password twice to confirm.

Select CREATE WALLET

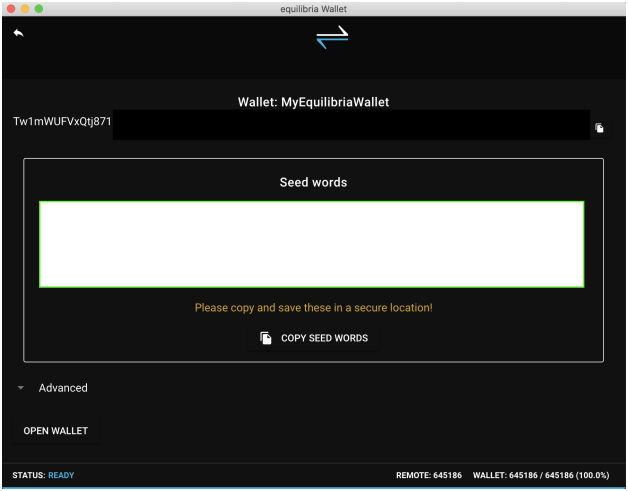

Step 12

Back up your Seed words

Using the Equilibria Wallet

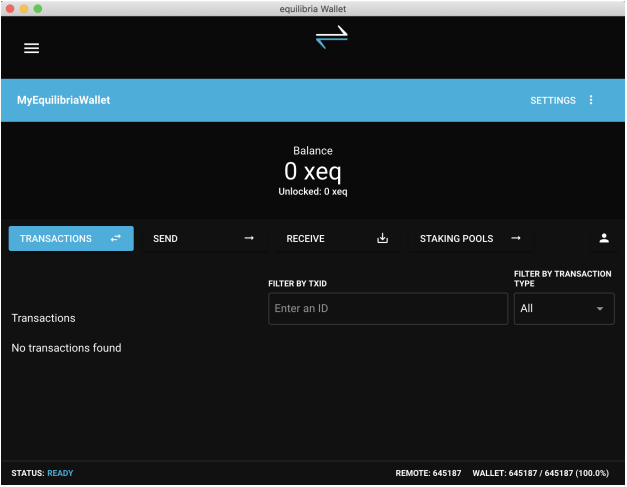

XEQ Balance and Transactions

Select TRANSACTIONS to check your balance and transactions.

Sending XEQ

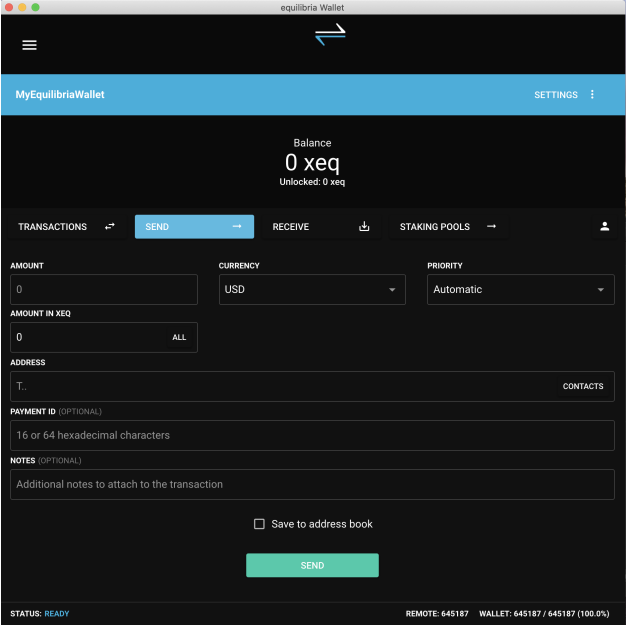

Select SEND to make an XEQ payment.

Enter address, amount, optional payment ID and click SEND.

Receiving XEQ

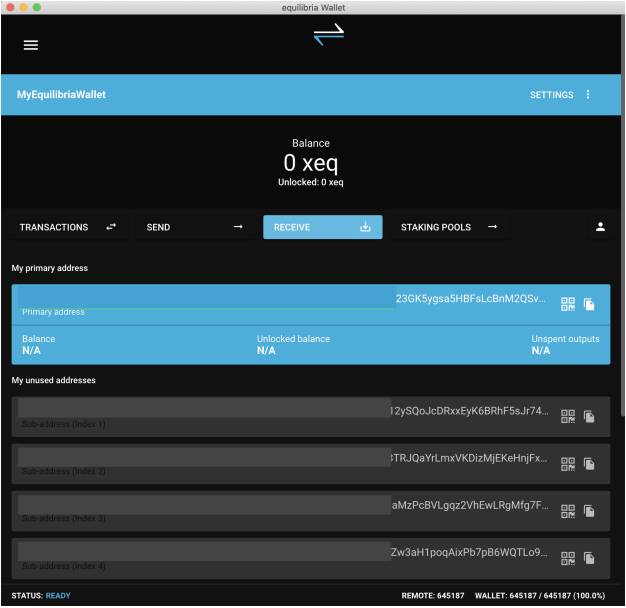

Select RECEIVE to copy a deposit address.

You have the option to use a Primary Address or a new Unused Address.

We recommend using a brand new Unused Address for every transaction to ensure maximum privacy.

Simply click on the right side of the desired address to copy it to clipboard.

XEQ Staking Pools

Select the STAKING POOL tab and you can scroll down to select which Oracle Node Pool you would

like to use. There are many pools to choose from as you scroll down.

Pick a Pool that charges less than 10% fees. We recommend staking a minimum of 1000 XEQ to

ensure you are above the minimum amount required for staking, which is currently around 750 XEQ.

Your staking transaction will fail if you do not meet the minimum required amount.

Select JOIN to select the Pool and then send your staking transaction. Funds will be locked up in that

pool for up to 30 days. You will see staking rewards come every 4 hours or so.

That’s it. You can now send, receive and stake XEQ very quickly in a simple GUI wallet interface.

XEQ Wallet Bug Report

Our wallet tests indeed confirmed the early stage of development of Equilibria. The Oracle Node

staking feature works as described, however the wallet balance was incorrect for a few days during the

30 day staking period. COINS ARE NEVER LOST, however users need to wait until wallet and

network sync up properly and the balance shows up correctly again. This could take anywhere from

1 to 30 days until the staking period is completed. We did report this bug to the Equilibria developers

so this will hopefully be resolved after the next update.

XEQ Links and Additional Information

Market capitalization/data:

https://www.coingecko.com/en/coins/equilibria

Equilibria (XEQ) BitcoinTalk Forums Announcement:

https://bitcointalk.org/index.php?topic=5170891.0

Equilibria (XEQ) Medium articles:

https://equilibriacc.medium.com/

XEQ July 2021 update/news:

https://equilibriacc.medium.com/equilibria-update-july-10th-75c884f0a6e6

XEQ Subreddit:

https://www.reddit.com/r/EquilibriaNetwork/

Equilibria network overview video: https://www.youtube.com/watch?v=QHwGKzqSwo8

Official Equilibria (XEQ) website:

https://www.equilibria.network/

XEQ Github: https://github.com/EquilibriaCC

XEQ Block Explorer: https://explorer.equilibria.network/

XEQ Official Twitter: https://twitter.com/EquilibriaCC