Very important disclaimer:

Solana (SOL) is a large cap crypto, witha current market cap of approximately $26 billion, whichranksitasthe 6th

largest crypto project (5thafter Ripple, whenyou ignore USD stablecoins). Wehave addedSOL to the TCV portfolio

with a 6% allocation.

Despite its large size and liquidity, it, like all of crypto, can be extremely volatile. Furthermore, we have philosophical

reservations about the project, which we discuss inThe Fundamentals section. If you are going to invest,make sure

you only invest what you can afford to lose.

Solana(SOL)

We are initiating coverage of Solana (SOL), with an allocation to our portfolio of 6%. The basis

for our recommendation is both fundamental and technical, with the former relying heavily on

anticipated adoption, competitive positioning and relative value. While our fundamental

valuation methods do not give a precise target indication (beyond appreciating that it could

reasonably go up several multiples from current levels), our technical analysis gives more

concrete short term and long term targets.

Our short/medium term target is in the $100 area (technical and psychological resistance)

and our long term target is in the $1000 area (psychological resistance which would be

triggered if BTC/USD reaches $100,000 and SOL/BTC reaches 0.01).

The Fundamentals

Note: Unlike reports for our other Featured Crypto Assets, we won’t go into as much

detail in this report on background. This is because, firstly, from an investment

perspective, it’s a relatively simple thesis that doesn’t require great depth of history.

Secondly, as it’s already a well covered large-cap project, there are ample resources

readily available, such as this Forbes article and the project’s perspective on its own

history from its official website

.

Solana (SOL) is a smart-contract network which competes directly with Ethereum. It has been

dubbed an ‘Ethereum Killer’, as it generally offers significantly better performance for

smart-contract computation, at a fraction of the cost. Like other L1 networks, the ‘fuel’ needed

to run applications on the network is the native token, in this case SOL. SOL functionally

works in the same way that the ETH token powers Ethereum activities.

At a high level, this sums up Solana in terms of ‘what it is’ – but it’s also very important to flag

one key element of its composition – where it came from. Unlike other grassroots crypto

projects, Solana was a Venture Capital (VC) project from the very beginning. In other words, a

bunch of institutional investors pooled their capital, and created the protocol in hopes that it

would be successful, and give them a long term return.

According to Crunchbase, Solana is funded by 42 investors who have invested over $315

million into the project over the years. This is very important to remember – as it puts it in a

very different class of crypto projects than those we typically have focused on.

Owing to its ‘corporate sponsorship’, transparent (i.e., surveillance coin) status, and centralized

Proof of Stake protocol, TCV sees Solana (like Ethereum) as largely anathema to the spirit of

true crypto. It stands in stark contrast to Proof of Work (PoW) cryptocurrencies like Bitcoin &

Monero, which were built by and for the community. As such, we understand that many of our

subscribers (and staff) might refrain from considering it as a serious investment consideration.

Nevertheless, from a valuation and trade consideration perspective, we view it as having a

very attractive profile (including, as a function of its larger market cap), the ability to deploy

more material sizes of capital without impacting the broader price. It’s this opportunity which

we wish to convey here.

There are a number of ways to appreciate the trade value proposition of SOL, all predicated

first and foremost on the notion that a large audience isn’t concerned with the philosophical

implications of which L1 they use (as evidenced by those who use Ethereum).

Unlike Ethereum, Solana scales on-chain. The high gas fees and slowness of the ETH

network compared to the high speed and low costs of transactions on SOL’s far more scalable

network will result in more intense competition and an attraction of investment capital to the

latter’s network. Solana is the holy grail for on-chain Proof of Stake (PoS) scaling.

With this in mind, the core value premise for the SOL token is relatively straightforward.

Solana’s technical and functional advantages make it a welcoming home to projects which

would otherwise look to live (solely) on Ethereum. As more projects live on the Solana

network, more users will require SOL to pay for those transactions on the network, meaning

they will need to buy more SOL – creating upward pressure.

The actual nature of this demand impact though is far more than the ‘purchase for fuel’

element. In fact, fees on Solana are so low (unlike Ethereum) that the average user doesn’t

need to hold ‘that much’ in his wallet at any given time to fund activities. This technically limits

the direct impact from a utility perspective.

The broader impact is more likely through social channels. While each new ‘onboarded’ user

or project may only create a relatively limited direct demand profile, the media and awareness

around such activities are likely to produce enthusiasm and speculative investment capital

movements. In other words, its successes will be in people’s minds and in the headlines, and

they will chase it on that basis. By virtue of the fact that its market cap is currently

approximately 8% of Ethereum’s, it can easily be viewed as having ‘a fair bit of room to grow’

as a serious contender to ETH’s dominance.

It’s not all clear skies for Solana though. For instance, Ethereum has a massive entrenched

economy, where much digital value has been created and stored. It’s not readily apparent that

Solana will be able to impact this. Further, the Solana network has had reliability issues, while

its large investor concentration means that a lot of tokens may ultimately be put up for sale (as

these investors look to cash out). Finally, as Proof-of-Work smart contract economies grow (on

Bitcoin and otherwise) more people may eschew the problematic PoS systems.

Despite these obstacles, there appears a solid secular thesis for value to accrue in the near to

intermediate term to SOL.

Ultimately, it is by far the more functional and usable alternative relative to Ethereum, and the

fact that it is corporate sponsored means that there are deep-pocketed advocates willing to

spend on marketing (which can be a major contributing factor to project uptake and success).

Sitting as we are (apparently) at the beginning of a bull market, it seems very reasonable to

think that SOL will begin to narrow the gap with Ethereum – compounding what we expect to

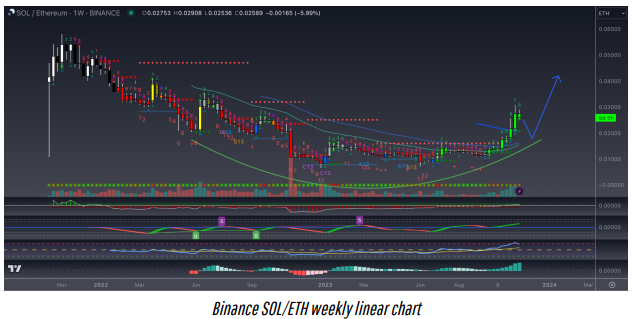

be upward pricing in ETH to begin with. This trend of outperformance has already begun with

the weekly SOL/ETH chart below looking like it has put in a healthy rounded bottom and is now

starting to ascend back into a bull market.

Granted, it has run quite a bit already and is

probably due for a pullback but we believe that this is our opportunity to get active on the long

side in this one.

As for fundamental price or valuation targets, we are unfortunately a bit limited here. Valuing

L1’s fundamentally tends to be more art than science, as it typically boils down to what we

perceive as a question of market share (taken from Ethereum) in an otherwise growing space.

With SOL trading at about 8% of ETH today, that effectively means it can rise as much as ~12x

as fast as Ethereum rises before it matches ETH in market cap. Could it go further than that,

and take the lead from Ethereum? Some, such as VanEck think it could, with their 2030

estimates going as high as a roughly 50x return from today’s levels.

We aren’t so bold as to support this longer term call, but we fundamentally see a sound case

for Solana to gain on Ethereum in the current/coming bull market, and so generate returns

significantly in excess of the latter’s. It seems entirely reasonable to think that SOL’s 8% of

ETH could rise to 2 or 3x that in the coming cycle. It’s against this backdrop then that we

largely defer to TA for investing strategies with price targets.

The Technicals

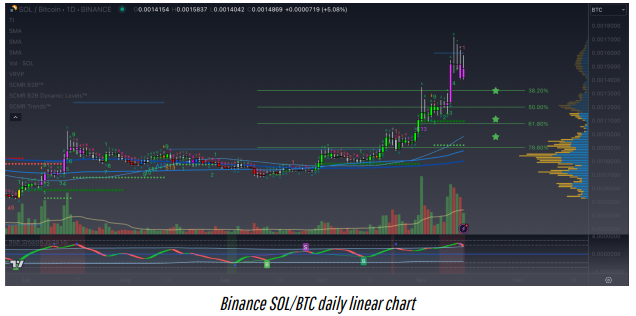

SOL is a favorable play due to great looking technicals across all time frames. Additionally,

both SOL/USD and SOL/BTC pairs look poised to outperform in the next major cycle, so

getting exposure should be accessible regardless of your capital base. The risk/reward for

purchasing around current levels, or slightly below, with such positive signals is an attractive

opportunity in our opinion, especially with short to medium term targets in the $100 region and

longer term targets closer to $1000.

SOL/USD

The SOL/USDT monthly chart has a confirmed bottom and is just getting started after shifting

to a bullish market structure. Momentum indicators have plenty of room to run to the upside

and TD count is early with the current TD 3 candle that looks poised to run up to a TD 9 as we

move into the 2024 bull market.

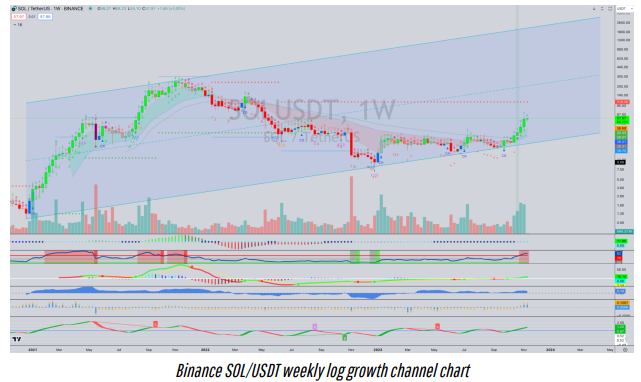

SOL has an absolutely beautiful textbook and well respected log growth channel. This type of

channel holding after an initial bull market is a rare event in altcoins so we most definitely want

to be holders of the asset going into this new bullish phase. The channel top can take us well

into 4-figure valuations, so purchasing SOL at current double digit prices will provide a nice

reward to holders who get in now.

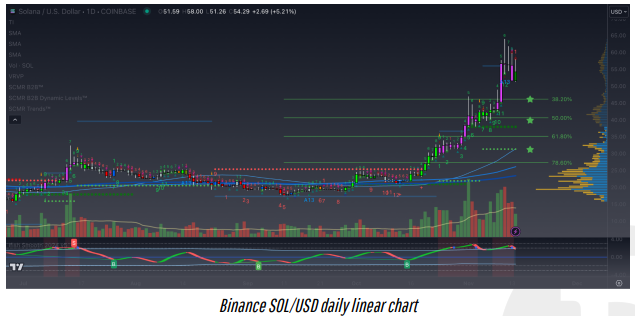

The SOL/USD daily chart above has just experienced a parabolic blow-off top and is now in

the process of beginning a healthy correction back into support in order to refresh the

technicals, washout late buyers, and establish bullish higher timeframe market structure, all of

which are good things for the market longer term. This should also give us an opportunity to

buy at lower levels as illustrated by the green buy stars above as well as those outlined on the

lower timeframe chart below.

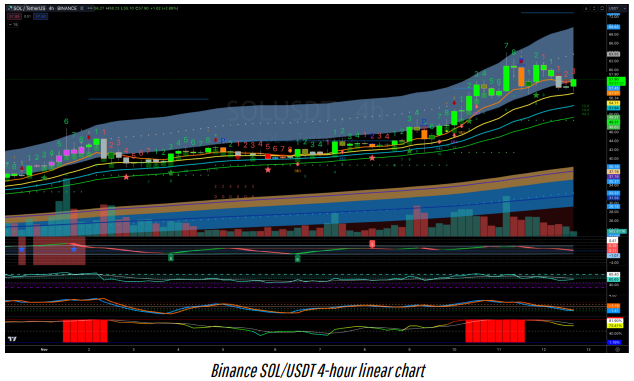

The 4-hour chart is in a fresh bull trend. If price falls below $54, favorable risk/reward buy

levels would fall in the $40-$45 range. This is the prime “buy the dip” level for those looking to

get their positions started.

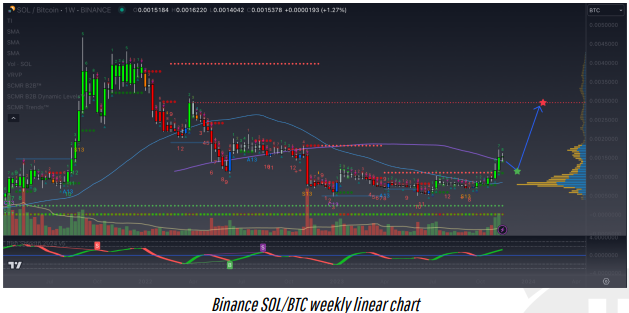

SOL/BTC

The SOL/BTC charts also look quite constructive overall with a short to medium term target

around 0.0030 and longer term targets in the 0.010 region, however a pullback is also

increasingly likely over the near term, hence giving us the chance we’ve been looking for to get

exposure on the long side going into the next bull market cycle.

As we can see on the daily chart above, SOL/BTC has been leading the recent altcoin run to

the upside resulting in a short term parabolic-type move that is likely to top out in the not too

distant future (if it hasn’t already). While this is somewhat unfortunate given our current

positioning, we think a buyable pullback is likely to materialize soon that should give us an

opportunity to buy a market structure higher low with a very favorable risk/reward profile, even

more attractive than nearer the lows given the improved technical setup.

Zooming out to the weekly chart we gain more perspective and can see that compared to the

previous cycle highs this one has barely gotten going. In fact, SOL hasn’t even reclaimed

pre-FTX levels at this time, which tells us that there remains plenty of room to the upside both

in terms of price and time. Having said that, we still expect a correction back to support over

the next month or two before true liftoff begins, which is good news for accumulators and

traders that are looking for alpha over the coming bullish cycle.

Where do I buy it?

Before buying, we cannot recommend highly enough to read the report on

coin control.

As of the time of this writing, SOL trades on many major exchanges. It’s not difficult to find it

on major KYC exchanges, including Binance, Coinbase and many others (though Binance is

by far the largest). Our preference when it comes to KYC would be Kraken, as they have

shown themselves to be good actors in an otherwise treacherous sea.

As for non-KYC exchanges, it is unfortunately not currently supported by TCV favorites

TradeOgre or Mandala as of the time of this writing, but it can be easily purchased in the

user-friendly Edge and Exodus self-custody wallets. Please note that exchange trading/swap

fees will be higher when using these wallets, due to processing by 3rd party instant exchange

providers. These services typically do not require KYC, especially when exchanging small

amounts.

Finally, MEXC is another exchange that lists SOL without requiring KYC, but it may not be as

trustworthy, so we recommend using it with caution. Keep in mind that MEXC is known to ban

all users that connect with a US-based IP address, so anyone who uses a VPN in an attempt

to circumvent geographical restrictions would need to be aware of this and make sure to never

connect from an IP address in a jurisdiction that violates their terms of service.

Always remember, don’t store your funds in an exchange for long periods of time – always

withdraw to your own self-custody wallet.

How do I store it?

There are many good wallet options to store your SOL. We’d generally suggest Phantom,

though there are many to choose from. You can review a list of them here, but realize that

some of them may want you to link the wallet to a personal account (like Torus) which we don’t

appreciate for privacy reasons. Our two recommended user-friendly multi-coin self-custody

wallets, Edge and Exodus, also both support SOL.

Risks

There are, as usual, several risks (besides the overall volatility of crypto generally) to be aware

of before considering investing in Solana (SOL), including:

- The mechanics of how L1s accrue in value are not well understood.

While this tends to not be much of an issue for smaller-cap L1s, the economic support beyond

Solana’s current valuation for ultra-low-fee networks has not been tested. It’s possible that a

major support to Ethereum’s price are token purchases to fund the significant gas fees. It may

turn out that with low fees, there is less fundamental buy support than for Ethereum, and

Solana could be a ‘more successful’ project, but with a smaller market cap. - The Solana network has had some history of technical problems.

There have been outages, hacks, and a general sense of lack of reliability. While Solana

wants to ultimately be the backbone for institutional transactions beyond NFTs, lack of

reliability could impede user adoption in those areas. - VC and institutional investors may still own several billion dollars worth of tokens.

The initial backers invested their capital in return for a lot of tokens, and an expectation that

they would at some point cash out. According to Capital.com, about 90% of all the tokens

were distributed to initial investors, team members and insiders. While it’s possible that most

of these holdings have been sold off to the broader market, we wouldn’t count on it.

Concentrated initial investor holdings means there is always the risk of a big sell order

dumping, or more likely (considering the financial sophistication of the parties) that any

meaningful rallies could just be funding the original investors’ exit.

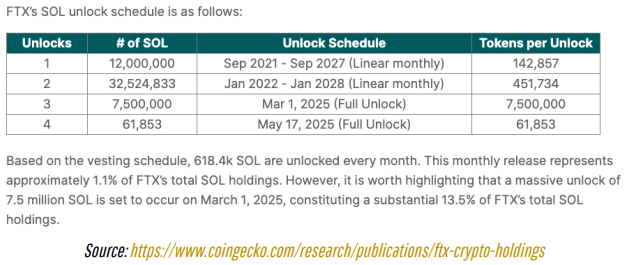

Furthermore, FTX’s bankruptcy estate still holds a large stash of SOL (it is currently its largest

crypto holding) and has chosen to stake the funds. These funds are expected to be unlocked

in various stages over the next several years up through 2028, as seen in the following table.

While clearly a negative overhang, we take comfort in the fact that these assets will only come

into the market in pieces and over time, and that the selling process will be professionally

managed (i.e., reckless dumping is unlikely). In the meantime, we believe there is plenty of

room for SOL to pump significantly in price.

Resources

Website: https://solana.com

Github: https://github.com/solana-labs

Documentation: https://docs.solana.com/

NFTs/MetaPlex Documentation: https://docs.metaplex.com/

Block Explorer & Indexer: https://solana.fm/

Block Explorer & Real-time Scanner: https://solscan.io/

Solana Network Status: https://status.solana.com/

Twitter/X: https://twitter.com/solana

YouTube: https://www.youtube.com/SolanaFndn

Discord: https://solana.com/discord

Telegram: https://t.me/solana

Reddit: https://www.reddit.com/r/solana/

Kraken Exchange SOL/USD pair: https://pro.kraken.com/app/trade/SOL-USD

Kraken Exchange SOL/BTC pair: https://pro.kraken.com/app/trade/SOL-XBT

Binance Exchange SOL/USDT pair: https://www.binance.com/en/trade/SOL_USDT

Binance Exchange SOL/BTC pair: https://www.binance.com/en/trade/SOL_BTC

CoinGecko Solana listing (live price, market cap, exchange currency pair list, etc.):

https://www.coingecko.com/en/coins/solana

Invest and trade wisely!